The 6-Minute Rule for Eb5 Immigrant Investor Program

The 10-Second Trick For Eb5 Immigrant Investor Program

Table of ContentsSome Known Details About Eb5 Immigrant Investor Program Eb5 Immigrant Investor Program - An OverviewFascination About Eb5 Immigrant Investor ProgramFacts About Eb5 Immigrant Investor Program UncoveredSee This Report on Eb5 Immigrant Investor ProgramRumored Buzz on Eb5 Immigrant Investor ProgramWhat Does Eb5 Immigrant Investor Program Do?What Does Eb5 Immigrant Investor Program Do?

The investor needs to look for conditional residency by sending an I-485 request. This application needs to be sent within six months of the I-526 authorization and need to include evidence that the investment was made which it has actually created at the very least 10 full time jobs for united state workers. The USCIS will certainly evaluate the I-485 application and either approve it or demand additional evidence.Within 90 days of the conditional residency expiry date, the financier needs to send an I-829 petition to remove the problems on their residency. This application must include evidence that the financial investment was continual and that it created at least 10 permanent jobs for United state workers.

Rumored Buzz on Eb5 Immigrant Investor Program

buck fair-market value. The minimum quantity of resources needed for the EB-5 visa program might be reduced from $1,050,000 to $800,000 if the financial investment is made in an industrial entity that is located in a targeted employment area (TEA). To get approved for the TEA classification, the EB-5 job need to either be in a backwoods or in an area that has high joblessness.

employees. These tasks should be created within both year duration after the financier has received their conditional irreversible residency. Sometimes, -the financier should have the ability to prove that their investment brought about the development of straight work for employees who work straight within the industrial entity that received the financial investment.

Top Guidelines Of Eb5 Immigrant Investor Program

It may be more useful for an investor to spend in a regional center-run task because the investor will not have to separately set up the EB-5 tasks. Financier has more control over day to day operations.

Capitalists do not need to produce 10 jobs, however maintain 10 already existing placements. Company is currently distressed; thus, the financier might haggle for a far better offer.

Congress gives local centers top priority, which can indicate a quicker path to authorization for Kind I-526. USCIS has yet to formally implement this. Capitalists do not require to develop 10 straight work, yet his/her financial investment must produce either 10 straight or indirect work. Regional Centers are already established.

The financier needs to show the creation of 10 jobs or potentially even more than 10 tasks if broadening an existing business. If business folds up within 2 year duration, financier might shed all spent resources.

Eb5 Immigrant Investor Program Fundamentals Explained

Compounded by its area in a TEA, this company is already in distress. Must typically stay in the exact same place as the business. If business folds within 2 year duration, investor can shed all invested funding. Financier needs to reveal that his/her financial investment produces either 10 direct or indirect jobs.

Generally used a placement as a Minimal Liability Partner, so capitalist has no control over daily procedures. Moreover, the basic companions of the local facility firm typically profit from capitalists' investments. Investor has the choice of buying any kind of business throughout the U.S. Might not be as dangerous because financial investment is not made in Related Site an area of high joblessness or distress.

Eb5 Immigrant Investor Program Can Be Fun For Anyone

Congress gives regional centers top concern, which could imply a quicker path to approval for Type I-526. Capitalists do not need to produce 10 direct tasks, however their financial investment ought to develop either 10 straight or indirect tasks.

If organization folds up within two year duration, financier can lose all invested capital. The financier requires to show the development of 10 jobs or possibly even more than 10 jobs if increasing an existing company.

The investor needs to preserve 10 already existing staff members for a duration of at the very least 2 years. Business is already in distress. Need to generally reside in the exact same area as the venture. Investors might locate mixture of $1,050,000 very cumbersome and risky. If a financier suches as to invest in a local facility firm, it may be much better to buy one that only requires $800,000 in financial investment.

The Main Principles Of Eb5 Immigrant Investor Program

Capitalist needs to reveal that his/her financial investment develops either 10 direct or indirect jobs. Normally used a setting as a Restricted Responsibility Companion, so investor has no control over daily operations. Furthermore, the general over at this website companions of the regional facility business normally benefit from investors' investments. For more details regarding EB-5 visas and Regional Centers, visit our EB-5 committed internet site or call Migration Solutions LLC..

The 3-Minute Rule for Eb5 Immigrant Investor Program

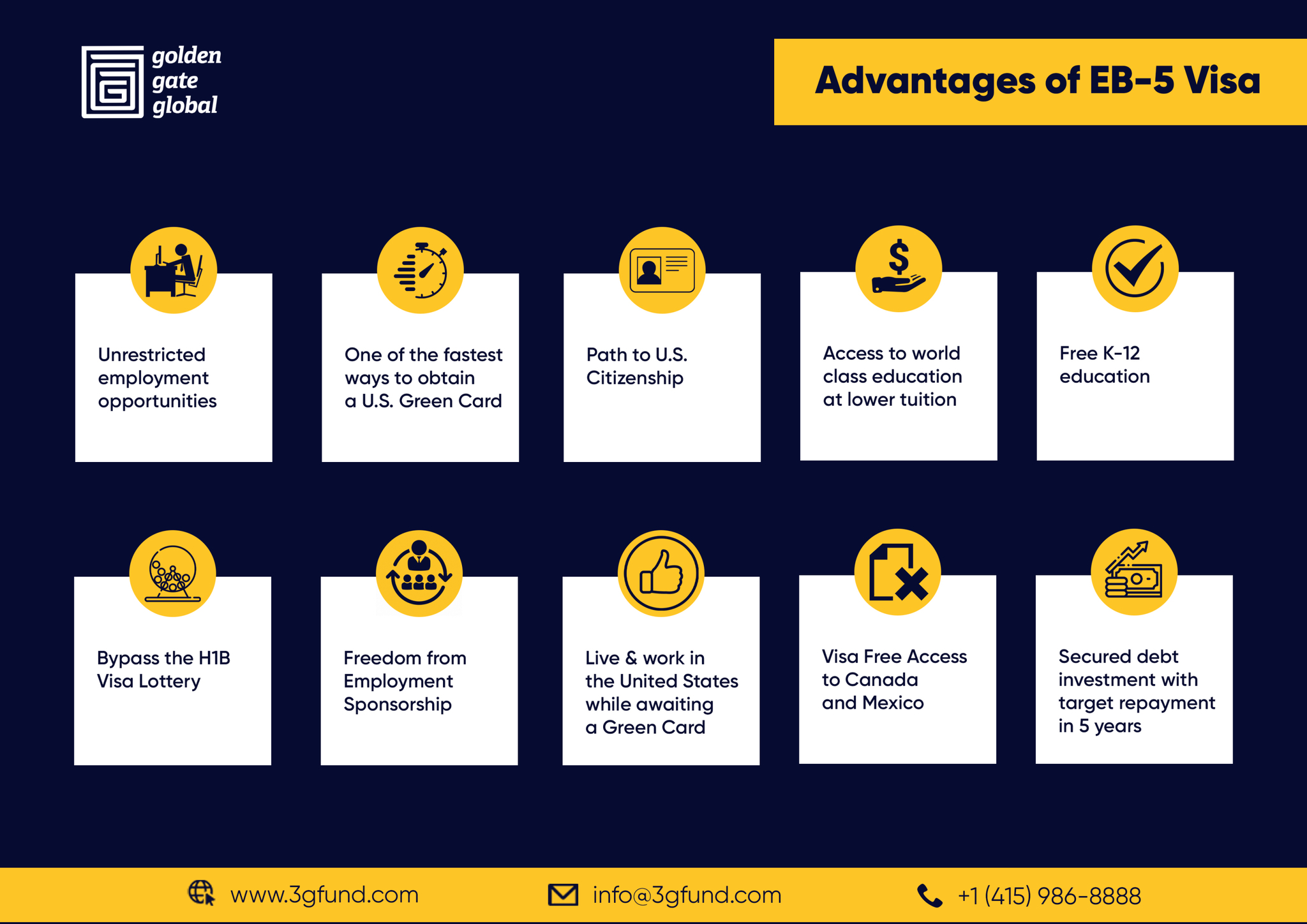

Let's break it down. The is an existing investment-based immigration program created to promote the united state economic situation. Developed in 1990, it grants international financiers a if they meet the following criteria: Minimum of $800,000 in a Targeted Work Location (TEA) or $1. EB5 Immigrant Investor Program.05 million in other places. The financial investment has to produce or maintain at the very least 10 full-time tasks for united state

Funds should be put in a company venture, either with direct investment or a Regional Center. Several EB-5 jobs supply a return on investment, though earnings can vary. Financiers can proactively take part in the U.S. economy, taking advantage of possible company development while safeguarding a pathway to U.S. irreversible residency. Reported in February 2025, the is a proposed option to the EB-5 visa.

The smart Trick of Eb5 Immigrant Investor Program That Nobody is Discussing

residency. $5 million (paid to the united state federal government, not a business). Unlike EB-5, Gold Card investors do not need to produce work. Trump has marketed this as a "Eco-friendly Card-plus" program, suggesting potential benefits beyond typical irreversible residency. The program limited to 1 million Gold Cards globally. Comparable to EB-5, it can ultimately cause U.S.employees within two years of the immigrant investor's admission to the United States as a Conditional Long-term Resident. For complete info concerning the program, please browse through. The investment demand of $1 million is decreased to $500,000 if a financial investment is made in a Targeted Work Area (TEA). In city locations, TEAs should have an unemployment price of at the very least 150% of the nationwide ordinary unemployment rate.